Join us at Property owners community. Telegram @SgPropertiesForum

Link to our Telegram group https://t.me/SGpropertiesforum

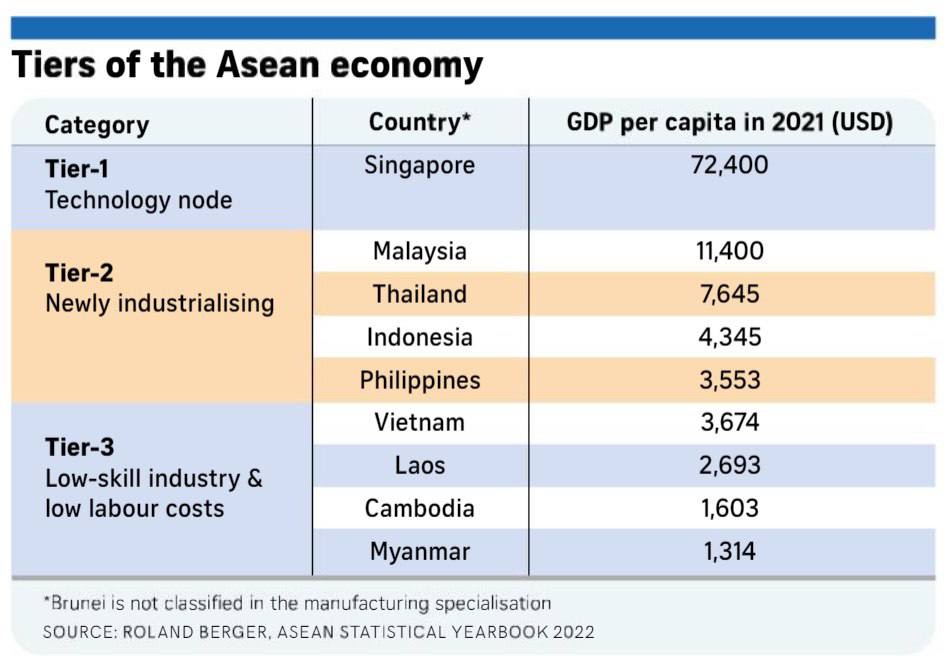

If buying for investment purpose, good to know the country’s income level too

Gross Domestic Product (GDP) is indeed a significant economic indicator that can influence overseas property investment decisions. GDP measures the total value of goods and services produced within a country’s borders over a specific period. Here are several ways in which GDP can be relevant to overseas property investment:

- Economic Stability: High and stable GDP growth is often associated with economic stability. Countries with robust and growing economies generally provide a favorable environment for property investment. A stable economy tends to attract investors and supports sustained demand for real estate.

- Income Levels: GDP per capita, which is GDP divided by the population, can provide insights into the average income levels of a country. Higher income levels often correlate with a stronger purchasing power, making the property market more attractive for investors, especially in the luxury and high-end segments.

- Employment Opportunities: Economic growth, as reflected in GDP, is linked to job creation. Countries with expanding economies typically offer more job opportunities, attracting a workforce and potentially increasing demand for residential and commercial properties.

- Currency Strength: GDP growth can impact the strength of a country’s currency. A strong currency is advantageous for overseas investors, as it enhances their purchasing power when converting their own currency into the local currency for property transactions.

- Market Trends: Investors often assess GDP growth trends to identify emerging markets and make informed decisions about when and where to invest. Rapidly growing economies may present opportunities for property appreciation and high returns on investment.

- Government Stability: GDP growth can be indicative of a stable political and regulatory environment. Political stability is crucial for protecting property investments and ensuring that property rights are respected.

- Infrastructure Development: Growing economies often invest in infrastructure projects to support economic expansion. Improved infrastructure, such as transportation and communication networks, can enhance the overall attractiveness of a location for property investment.

- Market Demand: GDP growth contributes to an increase in consumer confidence and spending, which can positively impact demand for various types of real estate, including residential, commercial, and retail properties.

While GDP is a valuable indicator, it’s essential for investors to consider a holistic approach. Other factors, such as local real estate market conditions, legal and regulatory frameworks, geopolitical stability, and demographic trends, also play crucial roles in determining the viability of overseas property investments. Conducting thorough research and seeking guidance from local experts are key steps to making informed investment decisions.

Let’s discuss in the telegram property community group https://t.me/SGpropertiesforum