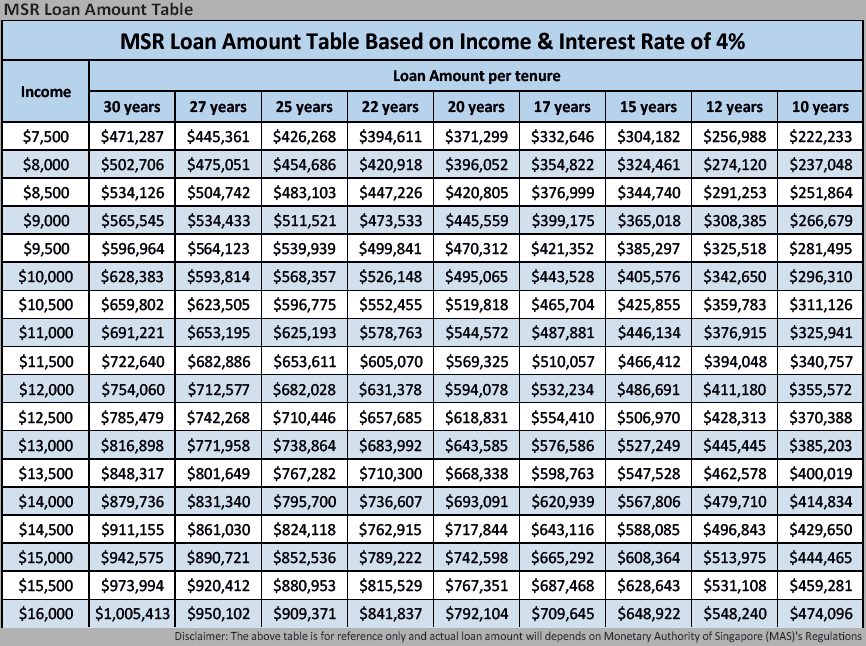

MSR Based on 4% loan table. Disclaimer: The above table is for reference only and actual loan amount will depends on Monetary Authority of Singapore (MAS)’s Regulations

Join us at Property owners community. Telegram @SgPropertiesForum

Link to our Telegram group https://t.me/SGpropertiesforum

In Singapore, the term “MSR” stands for Mortgage Servicing Ratio. The Mortgage Servicing Ratio is a financial calculation used by financial institutions, such as banks, to assess a borrower’s ability to service their mortgage loan based on their income.

Here are key points about the Mortgage Servicing Ratio (MSR) in Singapore:

- Calculation:

- MSR is calculated as the percentage of a borrower’s gross monthly income that can be used to service mortgage loan repayments. It takes into account the borrower’s monthly mortgage installment, property taxes, and property insurance.

- Regulatory Limit:

- The Monetary Authority of Singapore (MAS) sets certain regulatory limits on MSR to ensure responsible lending practices. As of my last knowledge update in January 2022, the MSR limit for residential property loans granted by financial institutions is capped at 30%.

- Applicability:

- MSR is a particularly relevant criterion for buyers of Housing and Development Board (HDB) flats and Executive Condominiums (ECs) in Singapore.

- HDB Flats:

- For buyers of HDB flats, the MSR is used to determine the maximum loan amount they can obtain from banks. It helps ensure that borrowers do not overextend themselves financially.

- Executive Condominiums (ECs):

- MSR is also applicable to EC buyers during the initial sales period (first 5 years). During this period, EC buyers must adhere to the MSR limit, and the EC units cannot be rented out.

- Loan Eligibility:

- Meeting the MSR requirement is one of the factors that influence a borrower’s eligibility for a housing loan. Financial institutions consider both the Total Debt Servicing Ratio (TDSR) and MSR when assessing loan applications.

- Total Debt Servicing Ratio (TDSR):

- While MSR focuses on mortgage-related obligations, TDSR takes into account all debt obligations, including credit card debt and other loans. TDSR has a broader scope in assessing a borrower’s overall ability to service debts.

It’s important to note that regulations and policies related to MSR and TDSR may be subject to updates, and borrowers should check with the relevant financial institutions or regulatory authorities for the latest guidelines.

Join us at Property owners community. Telegram @SgPropertiesForum